Driven by powerful environmental, macro-economic and technological factors, the global transportation sector is undergoing a historical period of transition. New business models like Mobility as a Service and the increasing economic viability of technologies like Electric Vehicles (EVs) will soon reshape how we travel.

I. Introduction: Global Age of EVs

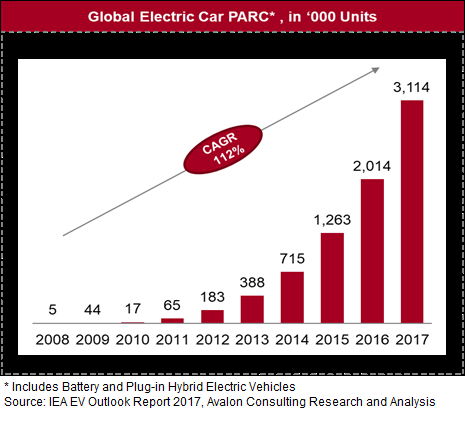

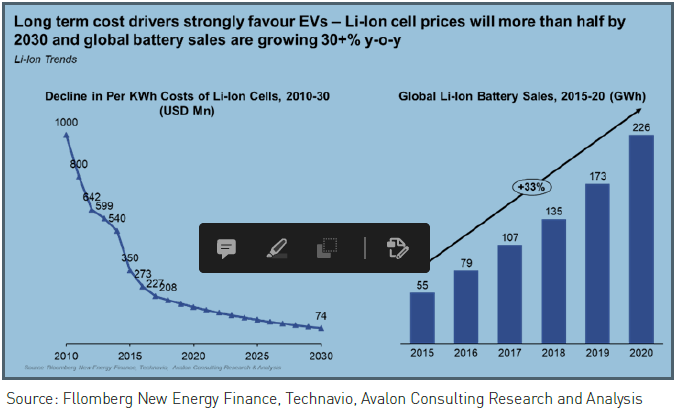

According to research by the International Energy Agency (IEA), the global EV parc has increased from just five thousand vehicles in 2008 to more than three million by 2017. This has been driven by key underlying trends including mounting environmental concerns, decreasing Lithium-ion battery prices and increasing availability of charging infrastructure. All this has led experts to predict a rapid growth in EV adoption in the next decade – current year on year growth projections range from 27% to 33% until 2030.

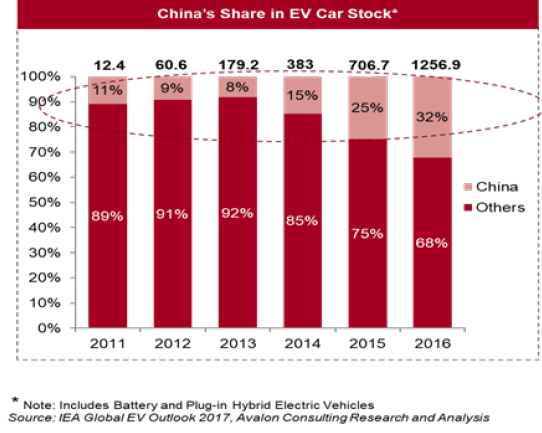

By many metrics, China is leading the world’s EV revolution. China’s share of the global EV parc grew to 32% in 2016, overtaking the US for the first time. Its share was only 11% in 2011.Private investment is pouring into China from major auto manufacturers like Daimler, BYD, Honda, Toyota and Ford, all of whom are actively exploring how to capitalize on China’s expanding market. Several lessons can be drawn from the China story, including its recent transition away from subsidies towards a dual-credit scheme that is expected to be launched in 2019. The dual-credit scheme rewards or penalises carmakers with positive or negative credits based on the car model’s fuel consumption and driving range. For example, if an automaker does not produce any EV, it will need to purchase EV credits from an EV maker to meet the government’s goal. Those with surplus credits can sell them in the market. EV models withlonger electric range will receive more credits. So, the extra cost from the subsidy phase-out can be offset by more credits.

By many metrics, China is leading the world’s EV revolution. China’s share of the global EV parc grew to 32% in 2016, overtaking the US for the first time. Its share was only 11% in 2011.Private investment is pouring into China from major auto manufacturers like Daimler, BYD, Honda, Toyota and Ford, all of whom are actively exploring how to capitalize on China’s expanding market. Several lessons can be drawn from the China story, including its recent transition away from subsidies towards a dual-credit scheme that is expected to be launched in 2019. The dual-credit scheme rewards or penalises carmakers with positive or negative credits based on the car model’s fuel consumption and driving range. For example, if an automaker does not produce any EV, it will need to purchase EV credits from an EV maker to meet the government’s goal. Those with surplus credits can sell them in the market. EV models withlonger electric range will receive more credits. So, the extra cost from the subsidy phase-out can be offset by more credits.

II. India’s Policy and Challenges

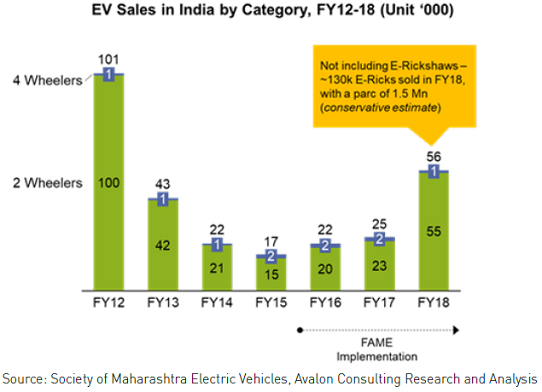

In contrast, the ‘official’ India EV story has been underwhelming so far. Absence of charging infrastructure, inconsistent government support and early product failures have all resulted in stagnant growth in recent years for the conventional vehicles. However, there has been unheralded growth in the electric 3-wheeler rickshaws, unofficial estimates put the number sold at 130,000 (three times the 2and 4 wheeler volumes!) with an installed base of ~1.5 mn (half the world’s population of EVs!). Unfortunately, India would not like to acknowledge this fact as these vehicles are largely unregistered (though many of them operate under our noses in large cities like Delhi!) and recognising them will mean admitting our administrative failures (and acknowledging wide spread corruption at the grassroot level!). Almost all of these electric rickshaws are screwdriver technology, originated through Chinese imports of CKDs which have since been ‘indigenised’ through local fabrication with only the motors and some critical components being imported. It has inadvertently opened up a large market for lead acid batteries in India. Maybe it is time for us to take our official status as the country with one of the largest population of EVs.

Our official EV policy on the other hand continues to muddle along. We started off with a bang in 2017 when a clear and ambitious goal of 100% EV adoption by 2030 was officially communicated by the government and the country’s leading government think tank, NITI Aayog. SIAM countered this with a research paper stating that this is unlikely before 2047 and (justifiably) will put the significant investments being made to transition to BS VI at risk.Since then there has been a lot of backtracking and the confusion in the policy is evident in the latest FAME 2 policy. The Government has approved a budget of Rs 10,000 crore for FAME 2, applicable from April 1, 2019 for a period of three years, from 2019 to 2022. But the subsidy will be only applicable on commercial vehicles and public transport along with two-wheelers. The scheme will also offer exemption from road tax and registration charge for hybrids and EVs. However, the benefits of the FAME 2 scheme will be only available on the vehicles powered by lithium-ion batteries or more efficient power source. Additionally, FAME 2 also mentions the development and installation of EV charging infrastructure wherein 2,700 charging stations will be placed at different locations in Tier I as well as other cities in the country. The intention of this is to have at least one charging station in a grid of 3km x 3km to provide additional convenience to the operators of both commercial and public transport vehicles. These charging stations will be positioned on the highways as well in a distance of 25km. FAME 2 has the drafted with the right intentions by: officially acknowledging that e-ricks are a critical part of the EV ecosystem in India providing subsidy only for Lithium Ion powered vehicles (and not lead acid) recognising that we need to have an indigenisation plan in parallel to the growth of the industry which needs to be shaped by policy and we should not repeat the mistakes made with the mobile phone industry where import dependency on China resulted in a booming trade deficit and the lack of strong Indian brands with a cost competitive position laying adequate emphasis on public transport (buses and e-ricks) and leveraging demand aggregation through EESL focusing on 2 wheelers for driving private vehicle adoption, which will result in the subsidy going a long way in driving volumes consciously emphasising battery charging infrastructure and swapping as drivers of growth

However, the devil is in the details. By asking for a minimum level of 50% indigenisation from April 1st 2019 for being eligible for subsidy, the policy has effectively ended subsidy for the industry from this date – there is nobody with this level of indigenisation in the EV industry (the e-ricks are largely unregistered and hence even in the past was not claiming subsidy). By not recognising that the supply ecosystem is not ready and specifying thislevel of indigenisation from get-go, the policy has effectively killed the organised EV industry till the industry is able to ramp up the indigenisation. One of the largest component in the EV is the Li-ion battery. The fact that there is inadequate capacity for battery pack assembly to meet the needs of the industry has not been considered. Similarly, capability for other key components like motors, powertrain, etc. are yet to be developed of any scale. Given the low volumes of the industry, cost economics and interest and infrastructure among the eco-system players are critical bottlenecks to be addressed as part of any indigenisation journey. Thus, it is logical for the policy to specify such a level of indigenisation from a future date (say April 1st 2020, rather than 2019). This wouldhave given the Indian players the time required to make the adjustments.

Industry players are making representations to allow changes to the policy but the outcomes will be known in the next few months. In the meanwhile, one can expect a sharp dip once again in the EV sales in FY20

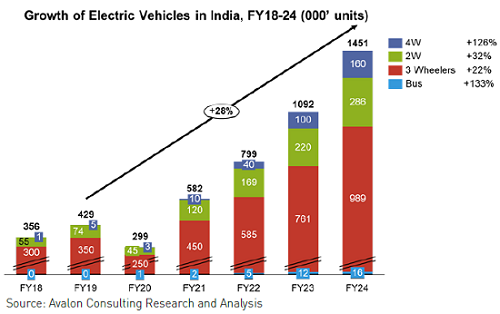

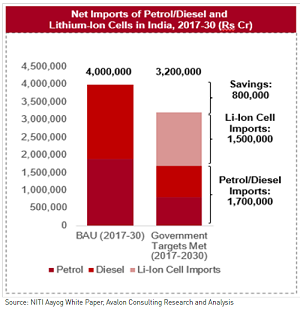

III. Implications for India: If both demand aggregation and battery swapping are successfully implemented, we project India reaching EV sales of around 1.5 million vehicles in FY24. This is an overall Compound Annual Growth Rate (CAGR) of 28% from FY19. Government procurement and public transport will be the major drivers of this growth, through procurement of vehicles for Government use and 3-wheelers and buses for public transportation. Growth in the 4-wheeler space is likely to be driven first by investments by private fleet operators like Ola and Uber, where higher daily running makes EVs more economically viable. The 2-wheeler space will be largely private ownership and subsidy driven, and will becharacterised by a migration from Lead Acid to Lithium-ion batteries and from low speed to high speed vehicles. Despite this promising growth, we expect that the originally stated target for full conversion to EVs by 2030 to be very ambitious and are likely to be missed due to the industry and consumers not being ready to adopt rapidly, given the relative economics. Our growth projections suggest that EVs will account for less than 2% of total vehicle sales by 2024. From that position, reaching the government’s goal of 100% penetration by 2030 seems farfrom achievable. The other key aspect to be noted is that the shift to EV will not necessarily result in a significant reduction in our import dependency. While cumulative oil imports for the automotive industry from 2017-30 in a “Business as Usual” scenario are expected to amount to INR 40 Lakh Cr, India would still have an import bill of INR 15 Lakh Cr for Lithium-ion cells and INR 17 Lakh Cr for oil in case it completes its transition to EVs. This results in a savings of INR 8 Lakh Cr. While India has a long way to go to achieve its EV ambitions, it is clear that EVs do present a short term high growth opportunity in key segments and will, no doubt be an inevitable disruption in the long-run; one that requires a cohesive strategy at both the government and corporate levels.

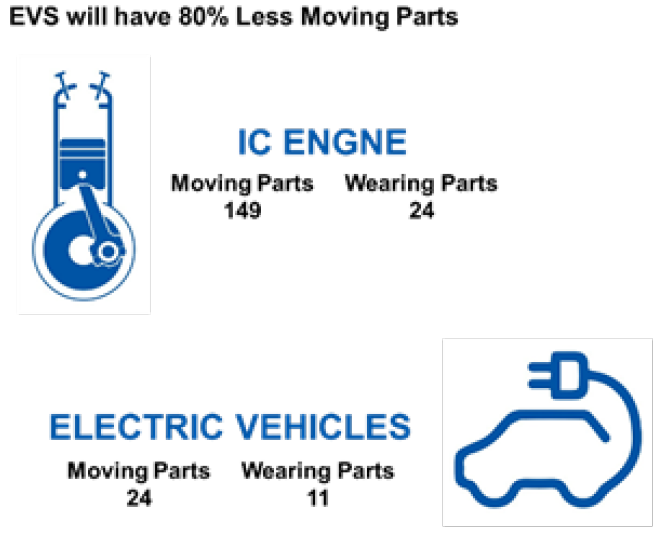

IV. Implications for Tool and Gauge Industry: Time to Re-tool?Engines and drivetrains are large drivers of the auto components industry. Engine and transmission together account for almost 50% of the total cost of a vehicle. Electric Vehicles would revolutionise this - 149 moving and 24 wearing parts would be replaced by 24 moving and 11 wearing parts in an EV.

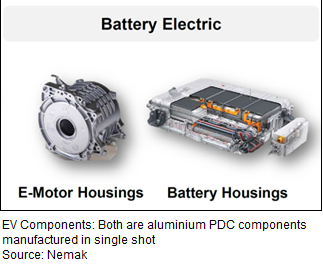

Over engine and drivetrain, including subcomponents, fasteners etc. it is estimated that 2000 parts in an Internal Combustion EngineVehicle would be replaced by less than 100 in an EV. Additionally, new parts introduced (like battery case/ cover, motor casing) would be mostly static and hence require less machining and joining compared to moving parts.All this has huge implications for the tool and gauge industry. As the number of parts and number of operations in those parts reduce, the requirement of tools would also reduce proportionately. Many these would be aluminium casting dies, sheet metal dies, forging dies as well as machining jigs and fixtures. Secondly, several of the current customers, particularly small and micro enterprises making small engine and drivetrain components, would need comprehensive overhaul in their business. Several may even go bust.

But on the other hand, EVs would call for more complex single piece constructs, and hence more complex, higher value add tools. The EV revolution is also expected to be accompanied by increasing use of telematics, power electronics etc. which would drive the increasing use of micro-components. Additionally, there would be requirements of plastic, sheet metal and cast components in charging infrastructure as well.

There is thus a need for substantial retooling in the tool and gauge industry.

Author:Sridhar Venkiteswaran (sridhar.v@consultavalon.com) and Subhabrata Sengupta(subhabrata.sengupta@consultavalon.com) lead the automotive practice at Avalon Consulting, a leading management consulting firm with considerable experience in advising clients on matters related to strategy and performance improvement (www.consultavalon.com)

By the Members, of the Members & for the Members

By the Members, of the Members & for the Members